The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. It plays a crucial role in the U.S. economy and financial markets, and its actions and policies significantly influence trading and investment decisions.

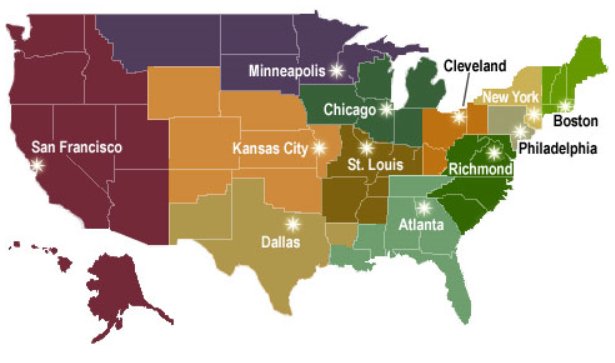

The Federal Reserve system is divided into twelve regional banks located in major cities across the U.S. The idea of a single central bank was purposefully rejected by the Federal Reserve Act framers. Rather, they established a central banking "system".

The Federal Reserve has several key goals that guide its monetary policy and overall functioning. These goals are designed to support the stability and health of the U.S. economy.

For example, maintaining stable prices and controlling inflation, promoting conditions that achieve the highest level of employment, preserving the purchasing power of the U.S. dollar.

Fed has a profound influence on financial markets through its monetary policy decisions and regulatory actions. Traders and investors closely monitor the Fed’s moves and statements to adjust their strategies and manage market risks effectively.

Comments

0 comments

Article is closed for comments.